Market Really Overbought For Now

Over the last 10 weeks, the market staged an impressive rebound from the June lows, increasing nearly 17%. That rise also reversed the vast majority of the previous“extreme bearish”sentiment as“Reddit Traders”plunged back into the“Meme Stock”game.

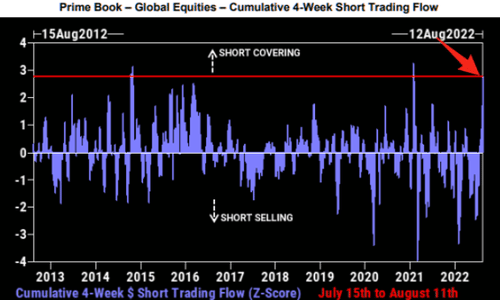

As discussed in last week’s report,the bearish reversal has been swift and caught many traders and investors flatfooted. Short-covering has been an essential driver of the advance, which has now hit record levels.

As we will discuss momentarily, the recent FOMC minutes also added to the bullish thesis by suggesting the Fed may be closer to slowing the pace of rate hikes as well. Furthermore, the market’s technical backdrop has also turned more bullish.

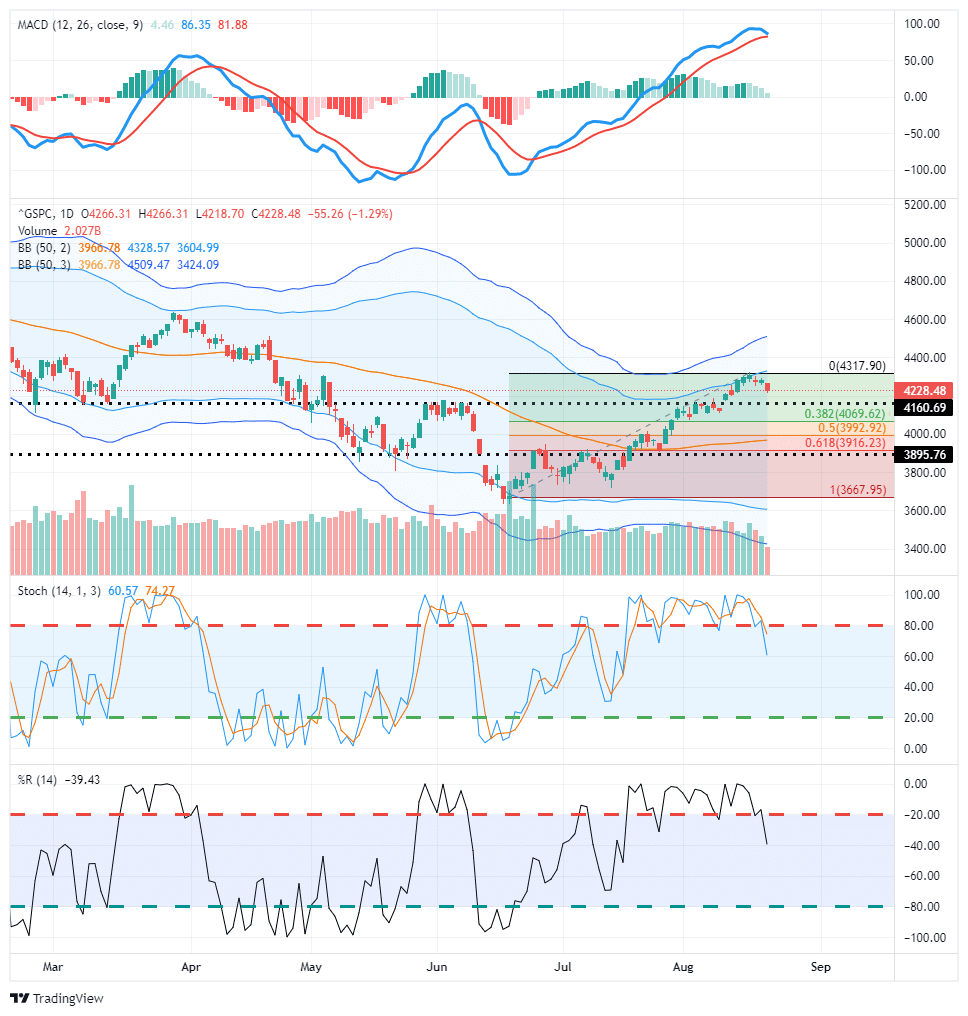

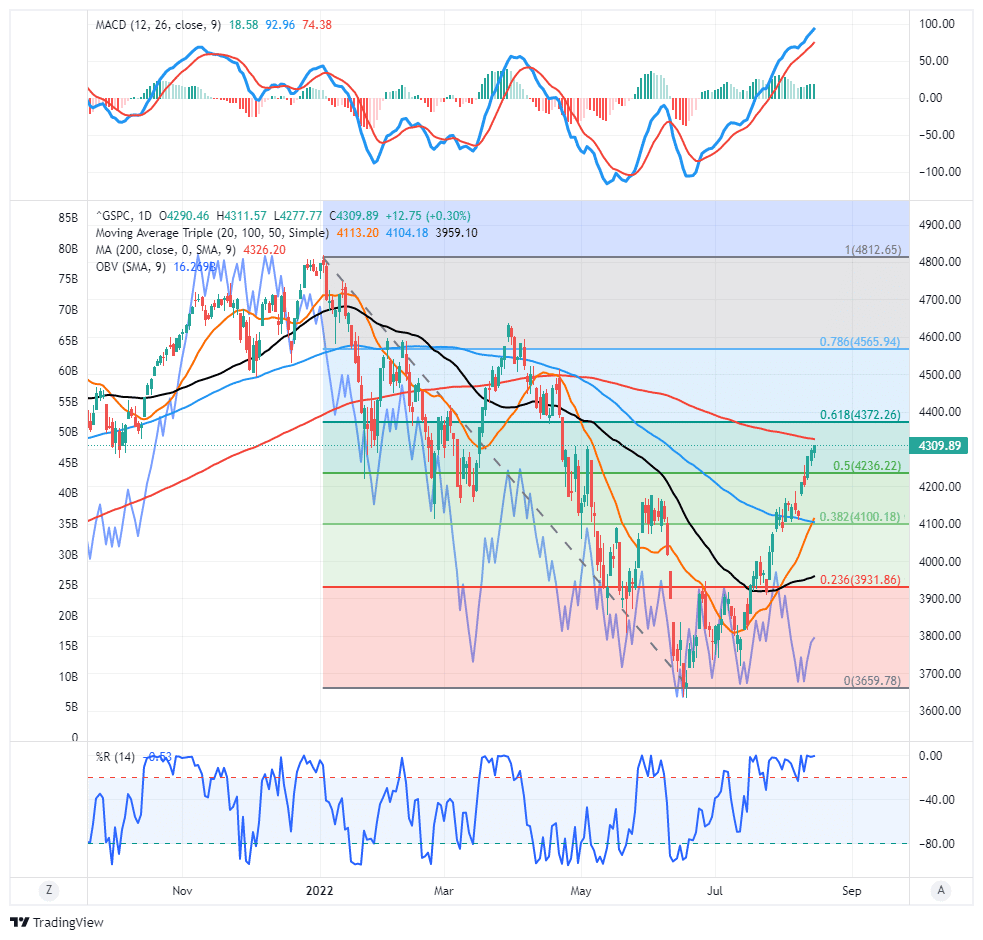

For investors, the market is now back to highly overbought conditions. As shown, the market is not only testing resistance at the 200-dma but is also well deviated above the 50-dma with the Relative Strength Index (RSI) back to more extreme overbought levels. The sell-off on Friday was expected, but we will have to wait and see if it is a one-day dip or a more sizeable retracement.We suspect we may see the latter with the MACD close to a sell signal.

The most logical retracement rallies are at the 100-dma (black-dotted line) and the 50% retracement level, coinciding with the 50-dma and previous support levels.A break below that, and we will retest lows.

As noted on Thursday,

“Such suggests that investors should consider taking profits and rebalancing portfolio risks while waiting for the market to pull back. A pullback would reduce the more extreme conditions and allow for a better risk/reward entry for increasing portfolio allocations. This rally has mostly focused on fundamentally sub-par companies, which now provides a better opportunity to swap into more fundamentally sound businesses.”

We are currently open to increasing equity exposure on a pullback to support. However, we are also well aware of the risk of a secondary decline if, as the FOMC minutes noted, the Fed does indeed further tighten monetary policy.

FOMC Minutes Excite The Bulls

On Wednesday, the FOMC minutes from the July meeting got released. Overall, a very measured group of statements meant not to upset the financial markets got bulls excited after their initial release. It was an interesting split of messages, effectively suggesting the Federal Reserve has no clue what will happen next.

On the one hand, “Fed Officials judged moving to a restrictive stance was required as inflation remains unacceptably high and inflationary pressures as broad-based.”However, on the other hand, officials also “Judged that a bulk of tightening effect was yet to be felt.”

While the FOMC minutes discussed the need to hike rates further as inflation remains“unacceptably high,”they also suggested moderation as the lag effect of rate hikes becomes apparent.Such was evident in their“dovish”statement that many officials saw a risk of over-tightening because of constant changes in the economic environment and the lag in the effect of monetary policy.In other words, that is the risk of a“policy error”we discussed previously.

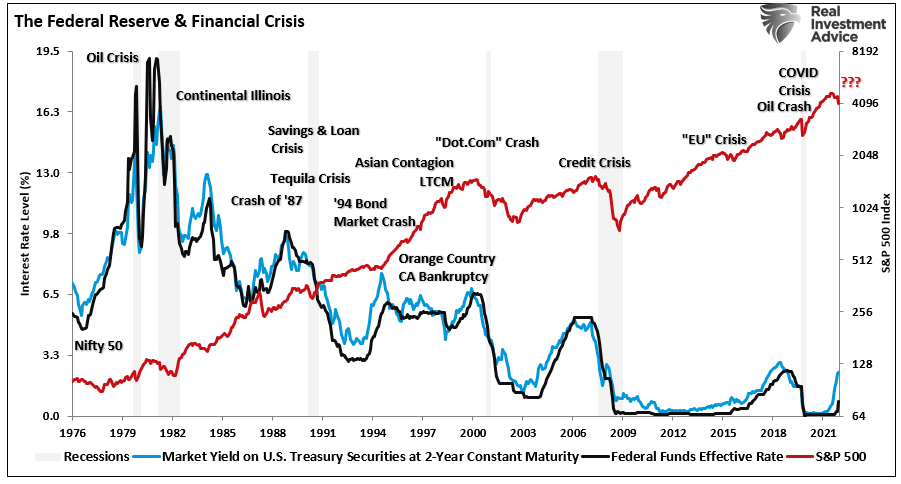

“Notably, Fed rate hiking campaigns correlate with poor financial market outcomes, as higher rates impacted the credit and leverage markets.”

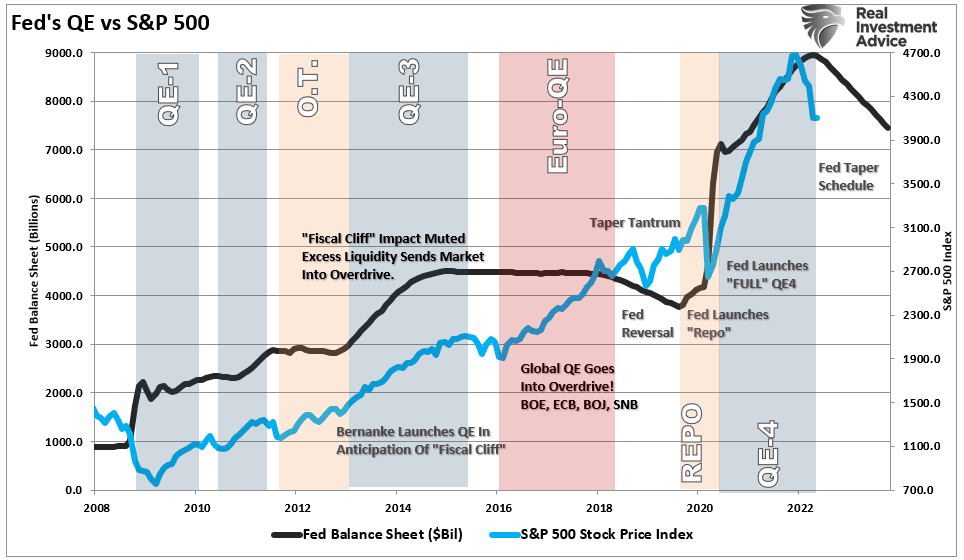

Such is particularly the case with QT running at $95 billion per month. When the Fed reduced its balance sheet in 2018, it ran at a pace of $30 billion monthly with very low inflation.Starting this month, the Fed will ramp up that reduction to 3-times the previous run rate, with inflation at nearly 9%.

That point was missing in the FOMC minutes on Wednesday.

The Bulls May Be Early

While the Fed believes it can achieve this reduction without disrupting the equity markets or causing an economic contraction, history suggests otherwise. As Michael Hartnett from BofA noted:

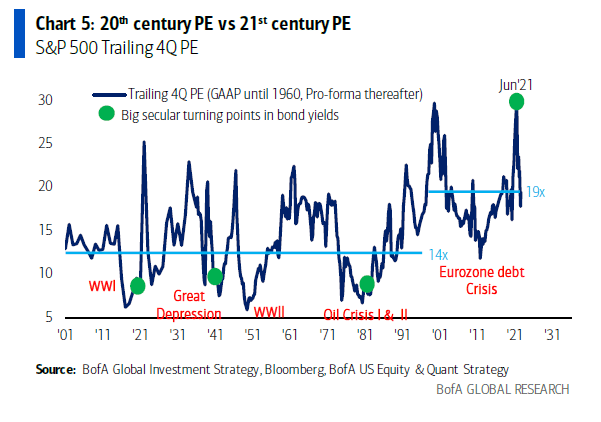

“S&P500 companies generated $220 of EPS per 12 months;applying a 20th century PE of roughly 15x gets you to an S&P500 index of 3300, applying a 21st century PE of 20x gets you to an S&P500 of 4400; there’s your range.

We say drivers of high 21st century PE all reversing.From QE to fiscal austerity, free movement of trade, people, capital, geopolitical peace there is a new regime of higher inflation. Such means the secular view remains cash, commodities, volatility to outperform bonds & stocks,It also means inflation in things we don’t have enough of such as energy, workers, places to rent, food, raw materials, good infrastructure, and military equipment. The deflation will be in things we have too much of from government debt, office space, mobile phones and streaming content.”

He further notes the recent rally was in line with historical bear market rallies.

“The average S&P gain in 43 bear market rallies since 1929 was 17.2%, with an average duration of 39 trading days. The current rally was 17.4% in 41 days, or as Hartnett puts it,textbook.Furthermore, bear-market rallies are always“narrow.”The recent rally was also narrow 30% of the entire gain in the S&P 500 coming fromjust 4 stocks: AAPL, MSFT, AMZN, and TSLA.

To Hartnett’s point, the Fed’s focus on combatting inflation, which means slowing economic growth, removes the drivers of the previous bull market. As the Fed noted:

“Once the policy rate had reached a sufficiently restrictive level, it likely would be appropriate to maintain that level for some time to ensure that inflation was firmly on a path back to 2%”.

Nowhere in that statement is a notion of cut rates anytime soon, which belies those jumping into stocks hoping for a“pivot.”

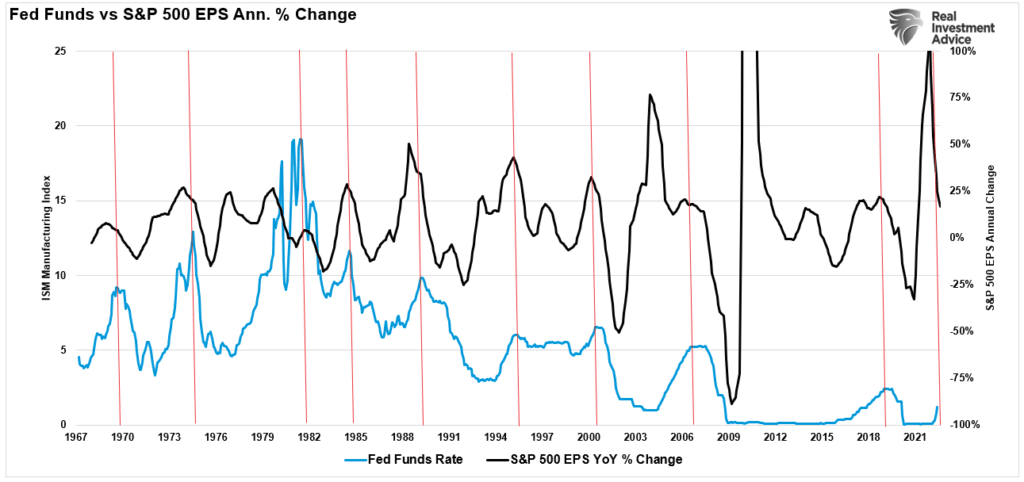

Critically, when it comes to the markets, both high inflation and rising Fed funds rates are already impacting both profit and earnings growth. Such will only worsen as the“monetary lag effect”arrives in early 2023. Such is where the risk of a further repricing of risk assets is most present. As shown, when Fed fund rates peaked, earnings growth continued to decline until well into Fed reversals.

We suspect the bulls may be a bit ahead of themselves.

50% Retracements & The 1960-70s

From a technical perspective, there is a rising bed of evidence supporting the“bear market is over”claim. One such bit of evidence comes from Ryan Detrick, CMT, who recently stated:

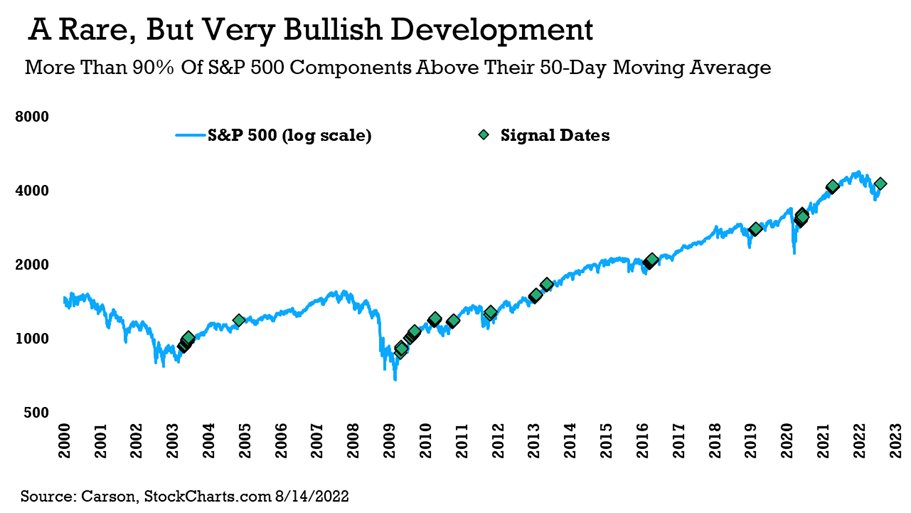

“Friday triggered a rare, but quite bullish signal. More than 90% of the components in the S&P 500 are now above their 50-day moving average. As you can see, these signals take place in strong uptrends historically.”

However, it isn’t just the number of stocks above the 50-dma but the market itself technically performing better. As noted above, an important indicator is a 50% decline retracement. When stocks have historically accomplished such a reversal, markets performed better over the next 12 months.

“Since WWII, every time the S&P recovered 50% of the bear market price decline, while the 500 may have re-tested the prior low, it never set a lower low,” Sam Stovall, Chief Investment Strategist at CFRA Research

Such is what happened in mid-August as the market rallied to its 200-dma.

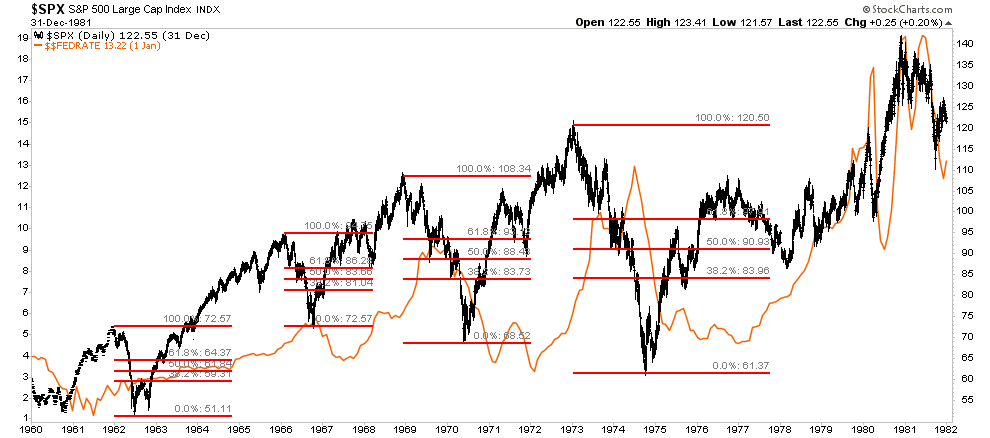

Many have suggested a 50% retracement of peak to trough declines always marked the end of a bear market. As shown below, that is true, except for a couple of essential points. First, as shown, there was only one period where the market rallied while the Fed was hiking rates, and the bear market, induced by higher rates, recovered and went on to new highs. Secondly, such was the beginning of a multiple bear market sequence that ended in the 1974 bear market that brought valuations down to 7x earnings.

Notably, during this entire period, the Fed was regularly hiking and cutting interest rates to combat a period of steadily rising inflationary pressures. Yes, each 50% retracement rallied to new highs as the Fed cut rates, only to collapse back to lower lows again.

While such a technical measure has a strong track record of suggesting the lows are in, it does NOT mean you should jump into markets immediately.

“Prior 50% retracements in 1974, 2004, and 2009 all saw decent shakeouts shortly after clearing that threshold.” – Jonathan Krinsky, Chief Market Technician at BTIG

While the short-term technicals are indeed bullish and argue for further gains over the next 12 months, such does not preclude another“bearish decline” in the markets first.\

Nguồn: //realinvestmentadvice.com/fomc-minutes-excites-the-bulls/