Judy Kwok,Head of Greater China Fixed Income Research

Ronald Cheng,Director, Greater China Fixed Income Research

China’s property sector has experienced unprecedented volatility over the past two years. After a raft of defaults and credit downgrades, which triggered a substantial drawdown in US dollar bonds, recent government policies have driven a strong rebound since last November. However, investors wonder if further upside is possible and, if so, which segments are most attractive? As Judy Kwok, Head of Greater China Fixed Income Research, and Ronald Cheng, Director, Greater China Fixed Income Research, explain in this outlook, the road ahead is likely to be bumpy but select opportunities still exist in the US-dollar high-yield bond space. Robust credit selection and valuation assessment have become even more important considerations in the current market environment.

China’s property sector has suffered a painful two years on the back of a shifting regulatory landscape and deteriorating economic conditions (See Appendix). After the Chinese government promoted (the unofficial) “Three Red Lines”policy in August 2020, property developers faced a new and challenging operational landscape when acquiring financing. The required deleveraging, coupled with uncertainty over future sales and liquidity, led China Evergrande, one of the largest developers at the time, to default in late 20211.

The failure contributed to a negative feedback loop: developers, unable to gain financing, stopped work on existing projects and cancelled new ones, limiting cash flow. Meanwhile, consumers stayed on the sidelines as property prices fell amid growing uncertainty and slowing economic growth.

The zero-COVID policies of the last three years added to the pressure as sudden lockdowns and halted economic activity further dented already fragile consumer sentiment. As a result, the sector experienced a cascade ofdefaults,credit downgrades, andwithdrawn credit ratingsin 2022.

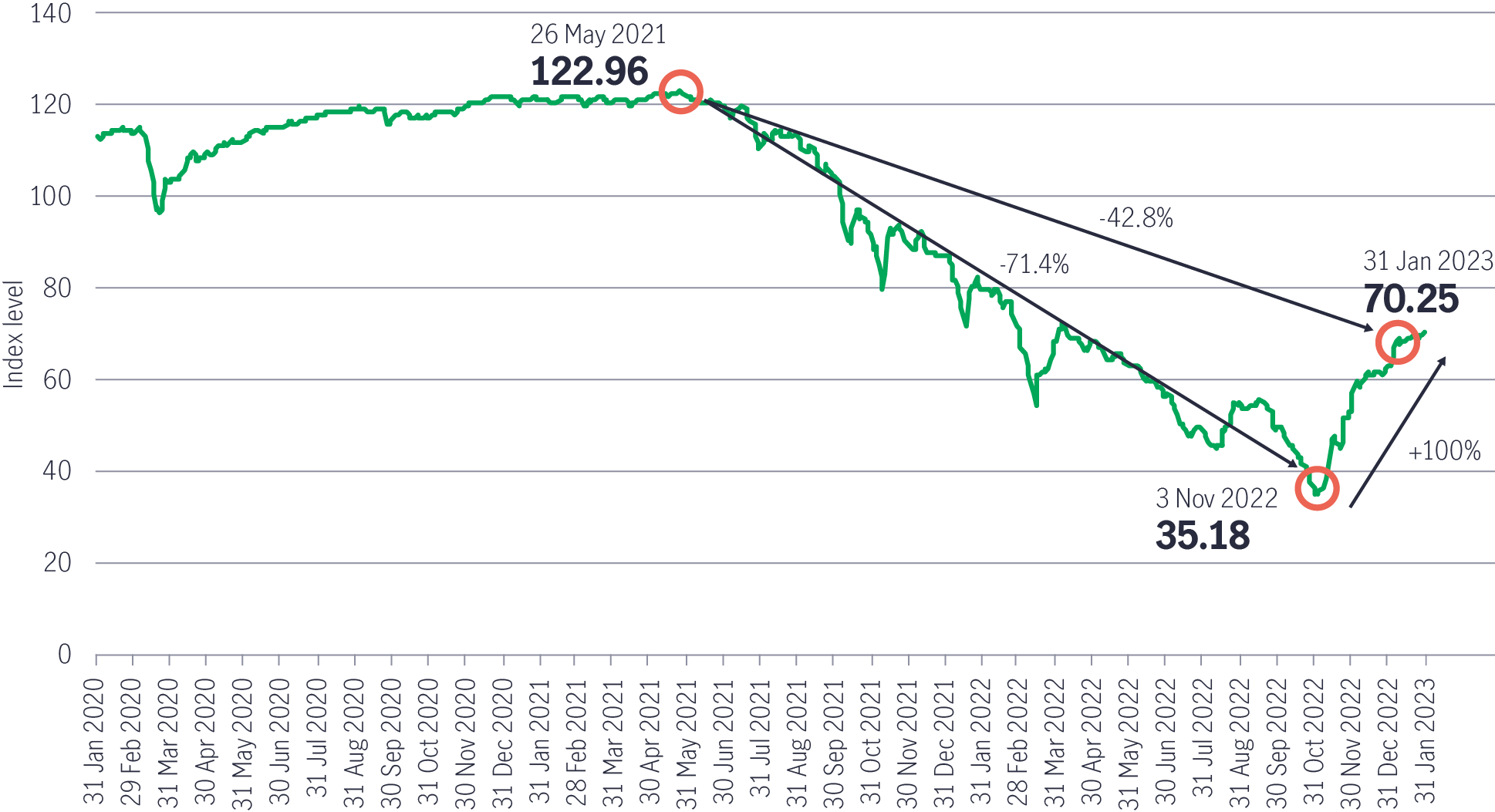

Overall, the J.P. Morgan Asia Credit Index (JACI) China Real Estate Index (total return) suffered a 71.4% loss from May 2021 to November 20222(see Chart 1). However, the Chinese governmentreleased a raft of new policiesin late 2022 to bolster the beleaguered sector.

The People’s Bank of China and China Banking and Insurance Regulatory Commission issued the “16 measures” in November to boost sector liquidity and ensure the completion of unfinished property projects. The policies ameliorated the prevailing illiquid funding environment, while reducing overall default risk.

The noted change in government policy tone and the faster-than-expected exit from zero-COVID catalysed a market rally. The JACI China Real Estate Index rebounded roughly 100% from early November 2022 to late January 2023, retracing roughly 40% of the drop from May 2021, still well below pre-crisis levels3(see Chart 1).

Chart 1: Drawdown and rebound in China’s property sector

Source: Bloomberg, JACI Index/China/Real Estate/ cumulative total return index, as of 31 January 2023. X axis: Level of JACI Index.

What’s next after the rally?

With the recent strong rebound in performance, investors may be asking: do opportunities still exist in the space – and if so, which segments are attractive?

We believe that the sector is unlikely to suffer a drawdown comparable to 2021-2022 again; the recently released policies, coupled with reopening the economy, have likely put a floor in the broader market.

Having said that, we also believe the opportunity set in this space has narrowed with recent market action. Indeed, opportunities in the quality US-dollar high-yield space are more selective in nature and require robust credit research to separate the contributors from the detractors.

To understand where the potential opportunities lie, we must first look at the challenges the sector still faces.

2023: Challenges remain amid economic uncertainty

For 2023, we see a broadly stabilised funding environment for investment-grade credits, but it should remain difficult for some of the weaker high-yield names. Indeed, offshore defaults may still occur amid the nascent economic recovery and continued ructions in the property sector; however, we believe they will not have the same deleterious market impact as they did in 2021-2022.

Perhaps, more importantly, we see macroeconomic recovery potentially playing a more important role in 2023 along with sector-based policy initiatives. Government policy served a critical role by rescuing tepid investor sentiment in 2022. Yet, the government will likely assess the market’s reaction to existing policies and, may, introduce further measures to enhance existing initiatives after the National People’s Congress is held in early March.

At this point, the government is likely focused on preventing the emergence of systemic risk in the sector and could intervene further if weak economic growth prevails. Thus, we believe economic growth and improved consumer sentiment should be the main catalyst behind further credit improvements in 2023.

Housing sales depend on sustained recovery and rising consumer sentiment

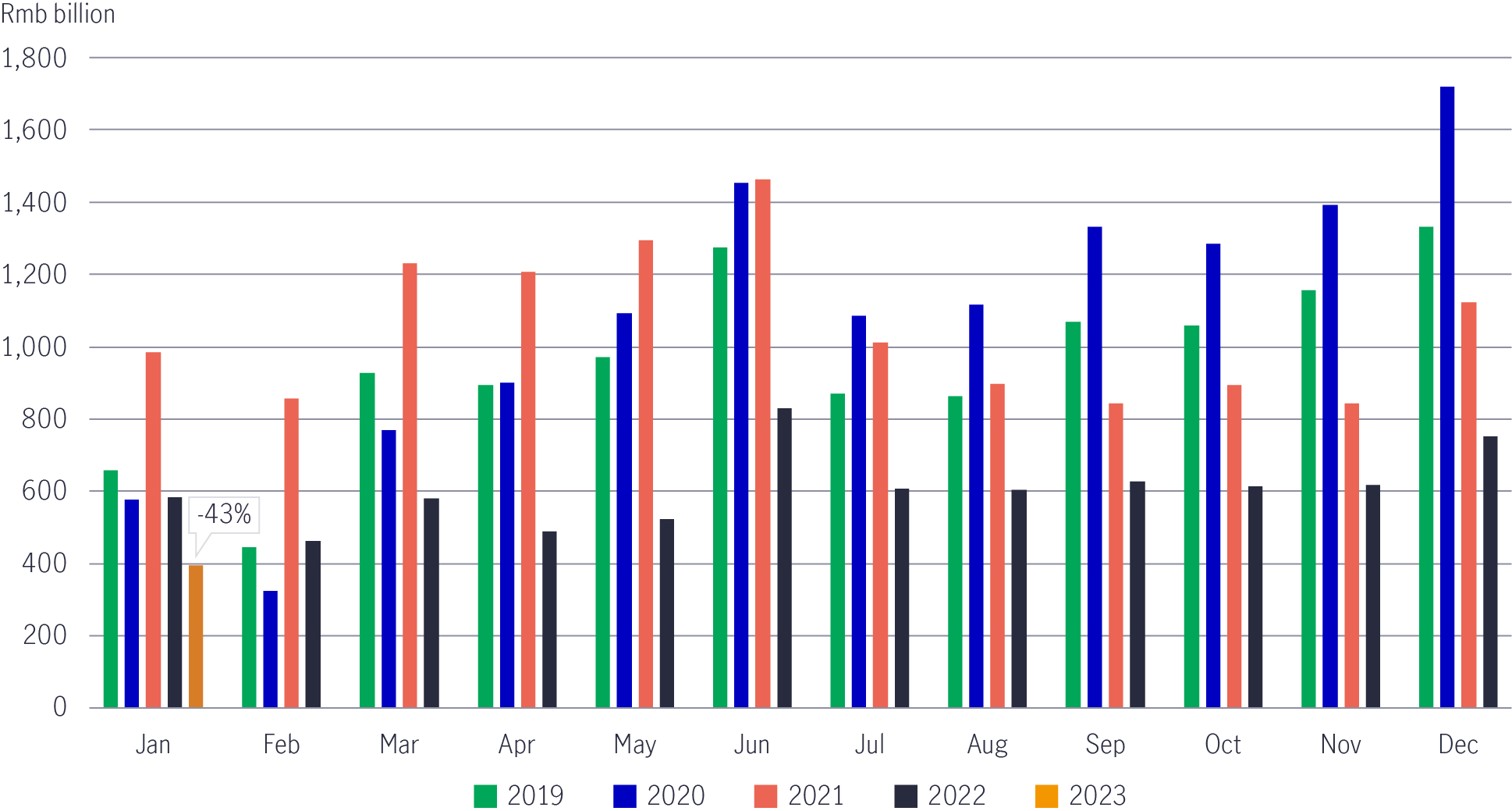

While we have witnessed some progress on the supply side via government policy, property demand is still a challenge. Indeed, primary home sales remain volatile and have not achieved consecutive months of growth – indicating weak signs of recovery (see Chart 2). We have seen some positive developments in secondary home sales; however, these transactions primarily benefit exiting homeowners, not developers.

Chart 2: Top 100 developers aggregate contracted sales (in billion RMB), 2019-2023

Source: CRIC (www.cricchina.com) and Manulife Investment Management, as of January 2023. Note: -43% represents the change in contract sales in January 2023 vs. the 4-year average of January from 2019-2022.

Overall, we believe that sustained recovery of primary home sales is unlikely until at least the second half of 2023. This is because: housing sentiment is broadly tied to consumer sentiment, which has only started to recover with the reopening of the economy since late 2022.

Although retail sales ended 2022 with three consecutive months of contraction and remain far below pre-COVID levels4, positive signs of improving sentiment were observed during the Lunar New Year period. Further, unemployment levels remain elevated compared to the historical average, particularly among younger workers. Any recovery is expected to be gradual.

With government policy aimed at stimulating broader consumption demand, coupled with improving sentiment, primary property sales should gradually stabilize.

Overall, we don’t expect real estate generally or home sales specifically to return to previous levels. The sector’s halcyon days, when it accounted for roughly 20-30% of China’s GDP, are well behind it. That said, a sustained recovery should go a long way to boost the bond prices of lagging developers. This is where we see attractive sectoral opportunities in 2023.

Select credit opportunities in weak but not distressed names

We see potential credit opportunities in the space divided into three categories.

1)Quality namesare primarily large developers, including many investment-grade credits, which have already benefitted from government stimulus policies. We think a large portion are already at fair value after the recent run-up, as investors broadly believe they will survive over the long term. We see limited opportunities for further upside in this group until we see a sustained primary sales recovery in the sector.

2)Distressed namesare those that have already defaulted or are in financial distress and face near-term default. For this group, valuation will likely be driven more by idiosyncratic developments in debt restructuring and asset liquidation. With the long time frame and uncertain recovery outcomes associated with this type of investment, we believe there are more attractive risk-reward opportunities elsewhere in this space.

3)Weak but not distressedare stretched developers in the high-yield space that possess the potential to survive and whose valuation remains attractive due to considerable uncertainty. Robust credit research is needed to select these names because they heavily depend on specific funding streams as refinancing needs arise, which is highly idiosyncratic.

We will look closely at two major factors to differentiate these credits on a case-by-case basis:

1) Contracted sales performanceis a proxy for having adequate cash flow available for debt repayment obligations.

2) Secondary sources of fundinginclude tapping onshore credit lines, asset disposals, and selling existing projects to service debt commitments. Refinancing options remain limited. Although the Chinese government has recently supported banks to offer outbound guarantees for some developers to secure offshore funding, this has largely been limited to larger developers with significant assets.

These aggregate funding sources are compared against developers’ upcoming bond maturity profiles – some have bonds maturing in 2023 versus others with a longer maturity runway over the next two-to-three years.

Conclusion

Although we expect a bumpy ride ahead for China property in 2023, select opportunities exist in the high-yield space after the recent significant market run-up. More robust economic growth, including a sustained recovery in primary home sales, could be a key condition for this group of credits to outperform. Credit selection should remain vitally important in this volatile market environment to differentiate those credits that will outperform.

Appendix: China High-Yield Spread Historical Changes

Manulife Investment Management, ICE BAML Emerging Market China High Yield Spread-to-worst Index as of 6 February 2023. PBoC= People’s Bank of China.